Trying to manage money solo is hard enough. Trying to manage money as a couple, a family, or a house full of roommates is a different game entirely.

Maybe this sounds familiar: you sort of have a shared budget in your head, you can never remember who paid for what, and rent and bills go out every month without anyone really seeing the full picture.

If you've been searching for a shared budget app, a budgeting app for couples, or a couples budgeting app with a shared dashboard, you're really looking for one simple thing: a calm, shared view of your money that everyone can understand.

A shared budget app does exactly that. It gives you one place to see what is coming in, what is going out, who paid for what, and whether you're on track for your shared goals, instead of relying on one person to do all the mental math.

Koody is built from the ground up as a collaborative budgeting app so you can manage shared finances together, without needing to merge every bank account or build another complicated spreadsheet.

Shared Budgeting App vs. Split-Expense Apps

Apps that split expenses are great for quick “who owes what” moments, but they usually stop short of real budgeting. A shared budgeting app shows your plan (budgets), your reality (spending), and your progress (category totals) in one shared dashboard. If you want less arguing and more clarity, you need both people looking at the same budget — not just a running tab.

Why Shared Budgeting Is So Hard

Most of us never learned how to manage money together. We merge lives, sign leases, split subscriptions, and then hope for the best. Unsurprisingly, things get messy quickly.

Common problems show up in almost every shared money story: no one has a real shared overview of income, bills, and spending; it is hard to keep track of who paid for what; and money conversations often start in a fog of stress and guesswork.

Traditional budgeting apps usually revolve around a single user. One login, one view, one person trying to piece everything together. Even popular budgeting apps that connect to bank accounts tend to focus on individual dashboards instead of true collaboration.

A good shared budgeting app flips that script. Instead of one person quietly acting as the CFO, everyone gets the same, simple view of shared expenses, shared budgets, and shared progress. That is the problem Koody is designed to solve.

How Koody Works For Couples

If you're sharing a home or a life with someone, you probably share a lot of financial responsibilities too. The question is not "Do we have shared expenses?" but "How do we track them in a way that feels fair and transparent?"

Koody turns that into a concrete, everyday workflow for couples: create a shared household budget, invite your partner, and track shared expenses in real time, all from your own phones and laptops.

1. Create A Shared Household Budget

Start by creating a shared budget for your life together, for example, "Our Household Budget." Add the categories that actually exist for you: Rent, Groceries, Utilities, Eating Out, Transport, Subscriptions, Savings, Kids, and so on. You can align the budget with payday instead of the first of the month if that is how your cash flow really works.

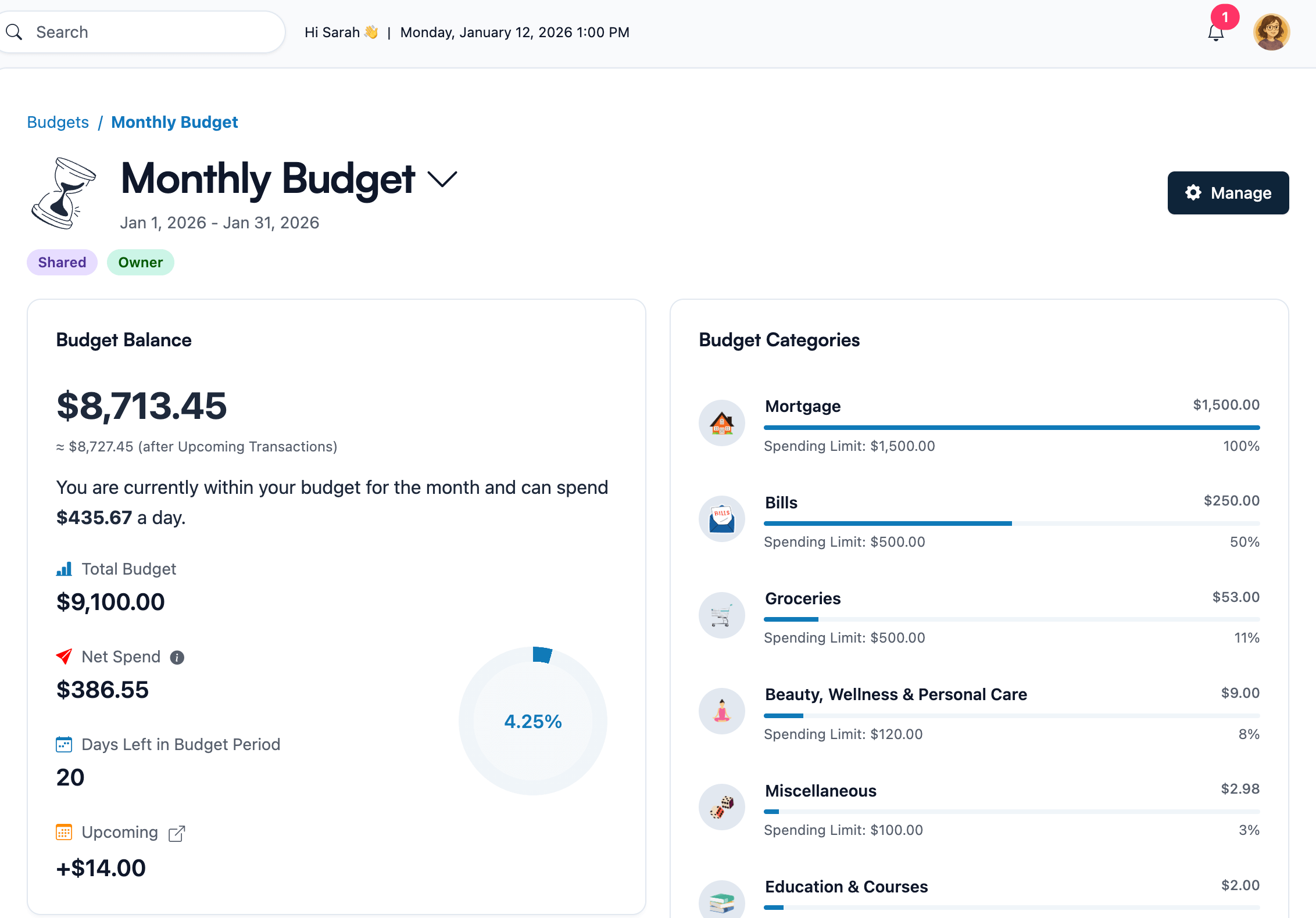

This becomes the core of your shared finances app: one place where both of you can see how much you planned to spend or save in each area, and how far along you are right now.

2. Invite Your Partner To The Budget

A budget is only shared if more than one person can see it. In Koody, you can invite your partner directly into the budget with their own login. You decide what they can do with clear roles and permissions.

You can have owners with full control, editors who can add and edit transactions, and view-only members who can see everything without changing the structure. That makes it safe to invite a partner in, while still keeping the budget organized.

3. Track Shared Expenses In Real Time (Shared Dashboard)

Once the shared budget is set up and your partner is invited, you can both start logging shared expenses: groceries, rent, household shopping, kids' activities, nights out, and more. You can connect accounts, import transactions, or simply record things manually as you go.

Each shared transaction can show which account it came from, which category it belongs to, and, if you want, who paid. Instead of guessing or combing through statements, you both see the same shared dashboard picture the moment an expense is added.

4. Budget Together With Separate Accounts (No Joint Account Required)

Many couples want a joint plan without a fully joint account. Koody supports shared finances with separate accounts so you can track shared expenses in one place and still keep your personal spending private. You decide what is part of the shared budget and what remains personal, and the app reflects that instead of forcing everything into one bucket.

How Koody Works For Families And Roommates

The same shared budgeting engine that works for couples also works beautifully for families and roommates. Anytime more than one person is responsible for bills, groceries, or shared goals, a shared budget helps keep everyone on the same page.

Families And Households

As a family budget app, Koody gives you one shared view of all the recurring costs that keep a household running: housing, utilities, food, school fees, kids' activities, subscriptions, and more. You can even create separate budgets for things like a vacation fund or a back-to-school budget, so big seasonal expenses stop being surprises.

You can invite family members into the budget with the right level of access, including view-only access for older teens who are ready to learn how the family finances work without being able to break anything.

Roommates And Shared Housing

As a roommate expense app, Koody helps you track rent, utilities, internet, and shared groceries in one place. You can record who paid which bill, what is still owed, and how the costs are split each month. Instead of going back and forth with vague messages about who owes what, you all look at the same shared house budget and the same numbers.

How Koody Keeps Shared Budgeting Transparent

Money conflict in relationships, families, and house shares is rarely just about the amounts. It is usually about surprises, missing information, and unspoken expectations. Koody is designed to reduce those friction points with clear roles, a simple shared overview, and helpful context.

Clear Roles And Permissions

Every shared budget in Koody can have owners, editors, and view-only members. That means you can safely invite people into your shared finances app without worrying that a single tap will rearrange your entire budget. Everyone knows what they can see and what they can change.

This structure is especially helpful for couples with different comfort levels around money, families with kids, or households where one person prefers to keep an eye on everything while others just need visibility.

A Shared Overview Instead Of An Interrogation

Because everyone has access to the same shared budget dashboard, you can talk about money from a place of "we" instead of "you." It is much easier to say, "We are getting close to our Eating Out budget this month, what do we want to do?" than, "Why did you spend so much on dinner again?"

The goal is transparent shared budgeting and better communication about finances, not constant debates about every coffee or ride share.

Koody AI For Calmer Money Talks

On top of the shared data, Koody includes Koody AI, an AI copilot that can help you think through money decisions together. You can ask how long it will take to hit a shared savings goal, how much room you have for extra spending this month, or what happens if one of you changes jobs. Instead of arguing over guesses, you can look at thoughtful answers grounded in your actual numbers.

How To Set Up A Shared Budget In Koody

If you've been wondering how to budget as a couple, how to manage household finances together, or how to keep track of who paid for what without fighting, you can set up a shared budget in Koody in just a few steps.

First, create a shared budget and name it something obvious like "Our Budget" or "Household Budget." Add the categories that cover your shared life: living costs, food, transport, subscriptions, kids, debt, savings, and anything else that matters for you.

Next, invite the people who should be part of that budget and choose appropriate access levels. Decide together how you want to split things—equally, by income percentage, or using your own rules—and be explicit about which expenses are shared and which are personal.

From there, log shared expenses as they happen and schedule a short weekly check-in where you look at the shared budget together. Those small, regular conversations keep you aligned and stop small misunderstandings from becoming big arguments.

FAQs: Shared Budgets, Answered

Here are answers to some of the most common questions people ask when they start thinking about budgeting together.

1. How Do I Track Spending Across A Shared Household?

The easiest way to track spending across a shared household is to put everything into one shared budget. In Koody, you log shared expenses into that budget as they happen or import them from statements, and the app keeps a running total for each category. Everyone in the household can see in real time how much has been spent on rent, groceries, utilities, and other shared costs, so there is less confusion about where the money is going.

2. Can I Create A Household Budget That Multiple People Can Access?

Yes. In Koody, you can create a household budget and invite multiple people into it, such as a partner, family members, or roommates. Each person has their own login and sees the same shared budget, categories, and activity on their own device. You control access with roles and permissions, so you can decide who can edit the budget and who should only have a clear, read-only view.

3. Can I Budget With Someone Else Through A Shared Account?

Yes — and you don't need a joint bank account. Koody lets you budget together with separate accounts by keeping shared spending in one shared budget, while personal transactions can stay personal.

4. How Can A Couples Budgeting App Help With Fair Bill Splitting?

Fair bill splitting is hard when you're guessing. A couples budgeting app helps because it creates a shared record of shared expenses. In Koody, you can agree on a split method and then rely on the shared dashboard to keep the conversation grounded in actual numbers.

5. What Is A Shared Budget App?

A shared budget app is a budgeting tool designed for more than one person. It provides a shared dashboard for shared income, bills, and spending, so everyone stays aligned on the plan. In Koody, a shared budget is a dedicated space with shared categories, transactions, and goals that everyone involved can see.

6. What Is The Best Budgeting App For Couples?

The best budgeting app for couples is the one that fits how you actually live. If you want transparency, shared goals, and the ability to budget together with separate accounts, Koody is built for that workflow.

7. How Do We Budget Together With Separate Accounts?

To budget together with separate accounts, you need a shared plan and a shared view, not necessarily a joint bank account. In Koody, you can keep your individual accounts, track shared expenses in a shared budget, and still protect personal spending. You decide which transactions count as part of the shared budget, and the app keeps everything organized.

8. Can We Use Koody For Roommates And Shared Housing?

Yes. Koody makes a great budgeting app for roommates and shared housing. You can track rent, utilities, internet, shared groceries, and other joint costs in one shared household budget that everyone can view.

Final Thoughts: Shared Money, Less Stress

Money is one of the biggest sources of conflict in relationships, families, and shared houses, but it does not have to be. A well-designed shared budgeting app gives you clear numbers, shared context, and a calmer way to talk about money.

Koody is built to be that shared budgeting tool: a shared budget app for couples, families, and roommates that combines manual entry, smart automation, shared budgets, roles, and AI guidance in one place.

Instead of relying on one person to keep everything in their head, you can all see the same picture, pull in the same direction, and build more trust around money over time.

Shared money will always require conversations. Koody is here to make those conversations clearer, kinder, and a lot less stressful.

Start tracking your spending in Koody today.