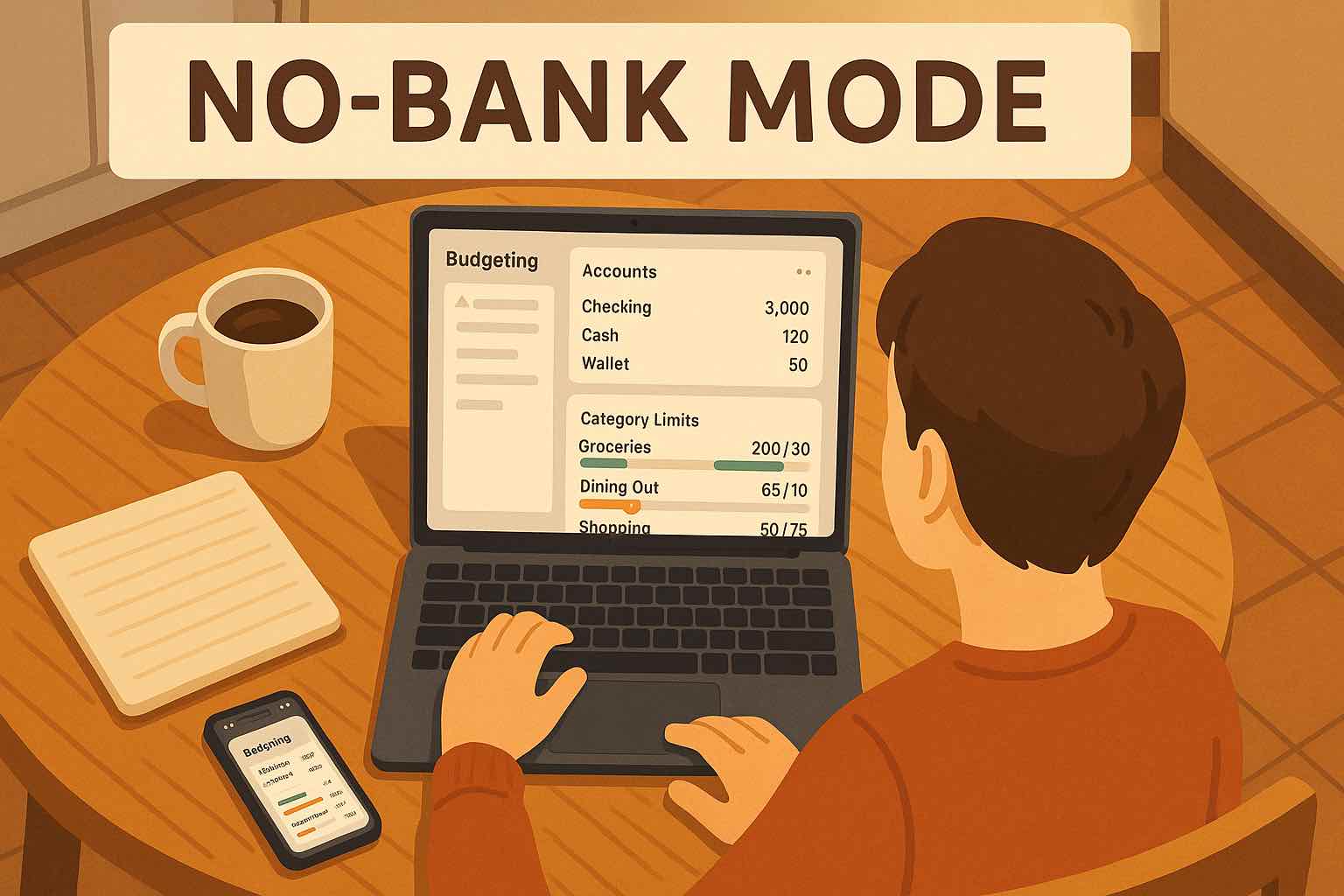

Budget without connecting bank accounts.

Koody is manual-first by design. Create manual accounts in seconds, then track transactions manually or import them from a CSV. Track spending, income, budgets, bills, and recurring payments — no bank login required.

How it works

If you've ever hit a "Connect your bank" screen and hesitated, you're not alone. Koody is built for people who want to budget without connecting bank accounts. Set up your accounts yourself — manually, privately, and on your terms. Want speed? Import a CSV. Want control? Enter as you go. Either way, your money stays understandable.

Start Without Bank Login

Add your accounts yourself in seconds. No bank passwords, no forced connections, and nothing to "sync" before you can begin. Set up checking, savings, credit cards, or cash accounts, then start tracking right away with a layout that stays simple even as your finances get more complex.

Import When You Want Speed

Once your accounts are set up, you can pull in history fast by importing transactions. Upload a CSV from your bank, import data from another budgeting app, or bring over an old spreadsheet you have been using for years. Koody auto-categorizes and highlights likely recurring items so you can clean things up quickly and move on.

Budget With Confidence

With manual accounts and transactions in place, the picture gets clear. Build budgets that match real life, keep an eye on upcoming bills, and spot overspending early while there is still time to adjust. The goal is calm control, so you always know what is left and what needs attention before payday shows up.

Built for people who want to start without connecting accounts.

Some people prefer bank syncing. Others prefer privacy, reliability, and control. Koody is made for the second group, without cutting features.

Privacy And Control

You can budget without sharing bank credentials or granting third-party access. You decide what goes in.

No Sync Drama

No broken connections, no delayed transactions, and no MFA headaches. Your budget stays reliable.

Works With Real Life

Cash, multiple banks, niche accounts, and irregular income fit naturally when you track on your terms.

Fast When You Want It

Manual-first does not mean slow. Import transactions by CSV when you want a quick history boost.

What do you do instead of linking a bank?

Add your accounts manually first. Then track transactions as you go or import them from a CSV when you want speed. Keep recurring items and budgets up to date, and your plan stays accurate because you control the inputs.

Koody is built for individuals and households who want clarity and control. Start manual-first, import by CSV when you want speed, and keep your plan accurate without relying on bank sync.

Manual-first accounts

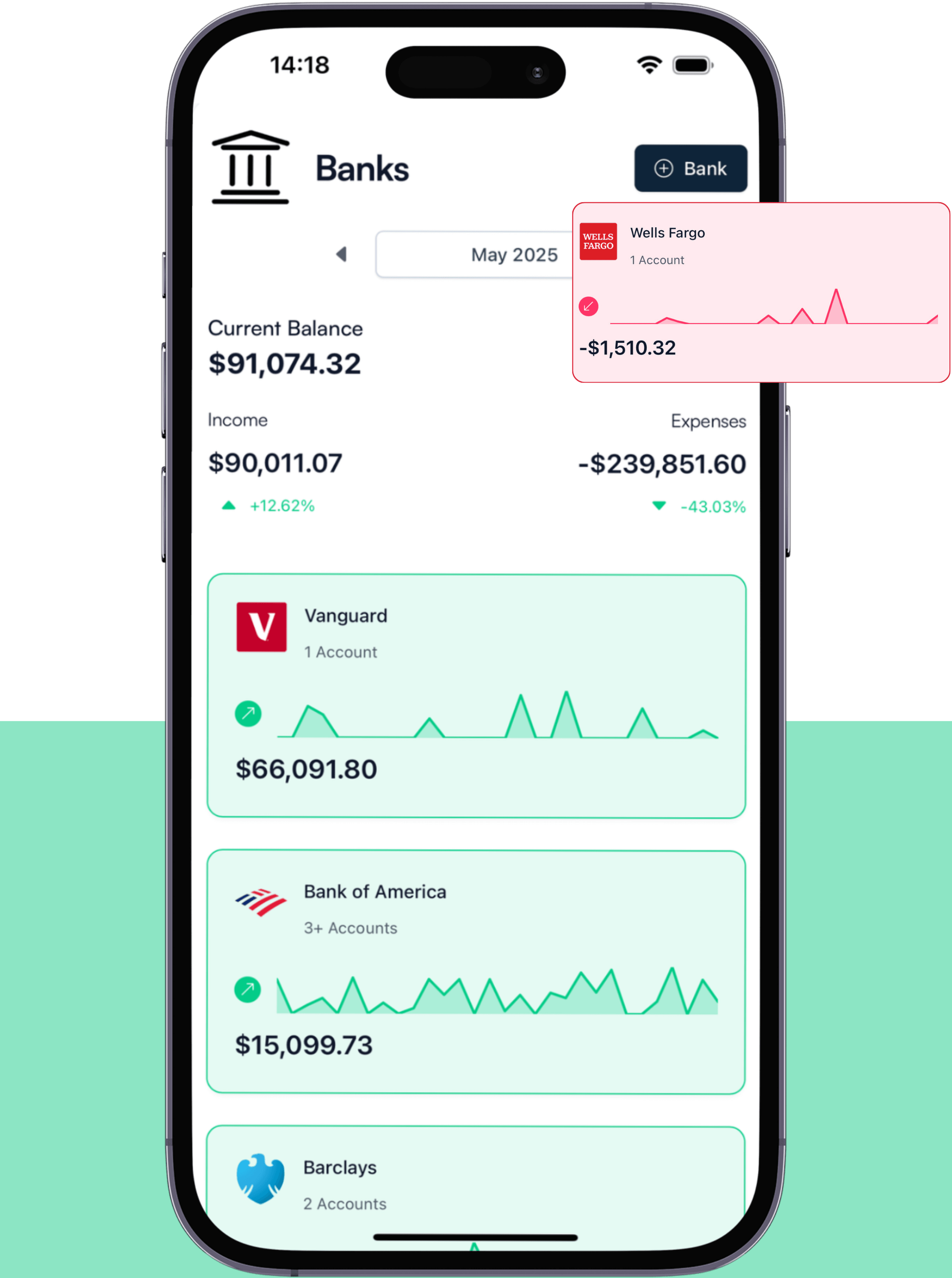

Add every account, even the ones that never sync.

Track checking, savings, credit cards, investments, crypto, and cash on hand. Your budget stays complete because it's built around your real life, not your bank's API.

- Add any account manually: checking, savings, credit cards, investments, crypto, and cash on hand.

- See everything in one unified dashboard, even accounts that never connect.

- Stay organized with a clean bank + bank account structure that matches real life.

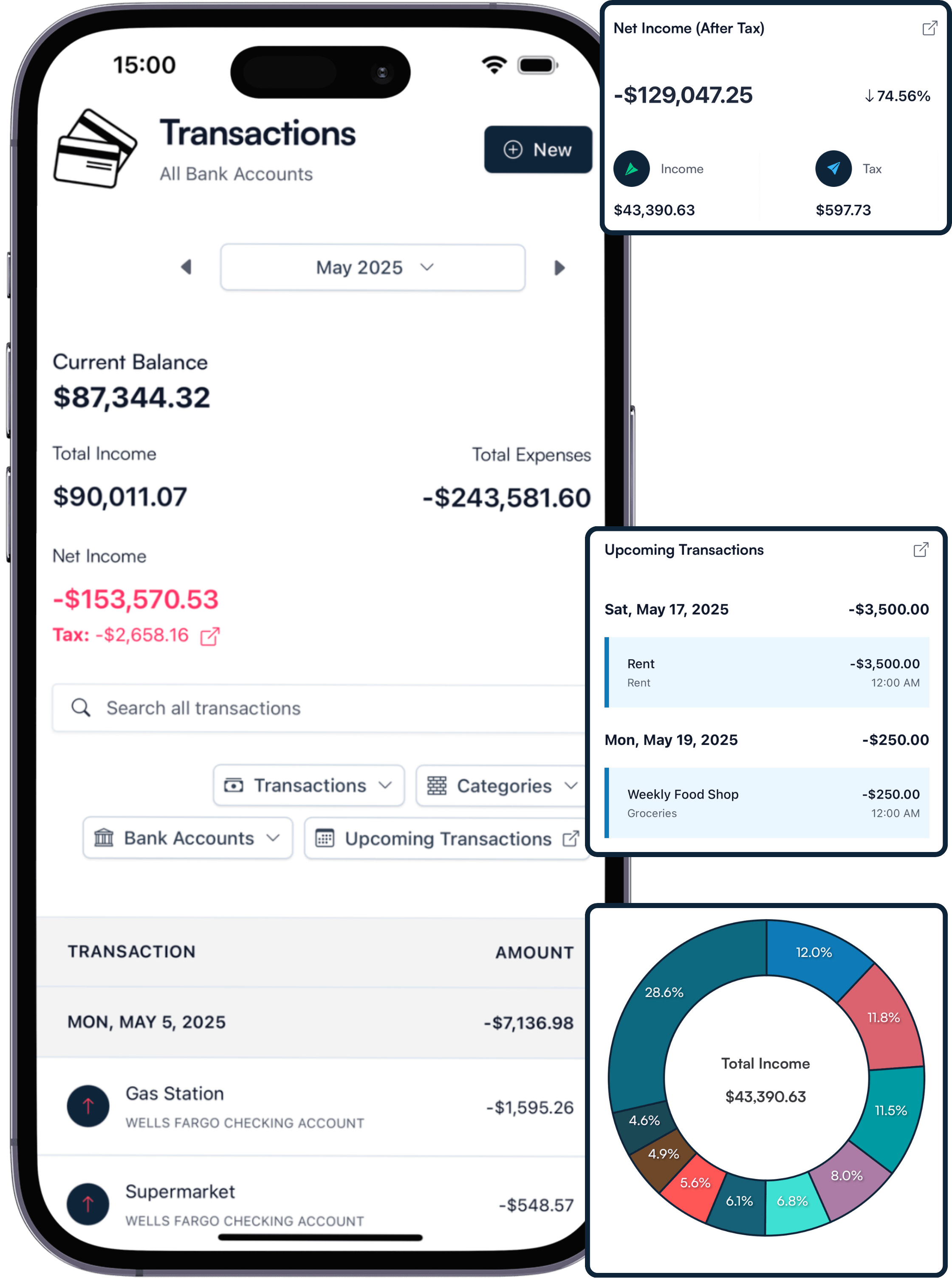

Transactions your way

Manual entries or CSV imports, you choose.

Enter transactions as they happen for maximum awareness, or import a bank statement when you want speed. Either way, Koody helps you categorize cleanly and spot repeat patterns without the sync drama.

- Track income and expenses manually, or import transactions from CSV statements.

- Set recurring items (subscriptions, bills, paychecks), so your plan stays current.

- Keep your numbers accurate with simple flags like taxable income when it applies.

Budgets

Build a budget that stays accurate without bank sync.

When you control the inputs (manual or CSV), your budget becomes clearer, not noisier. See what's left, what's overspent, and what's coming up so you can make decisions before money gets tight.

- Create monthly budgets or custom budgets that fit how you actually live.

- See what's left by category, what's overspent, and what's coming up next.

- Adjust as you go, because the point is progress, not perfection.

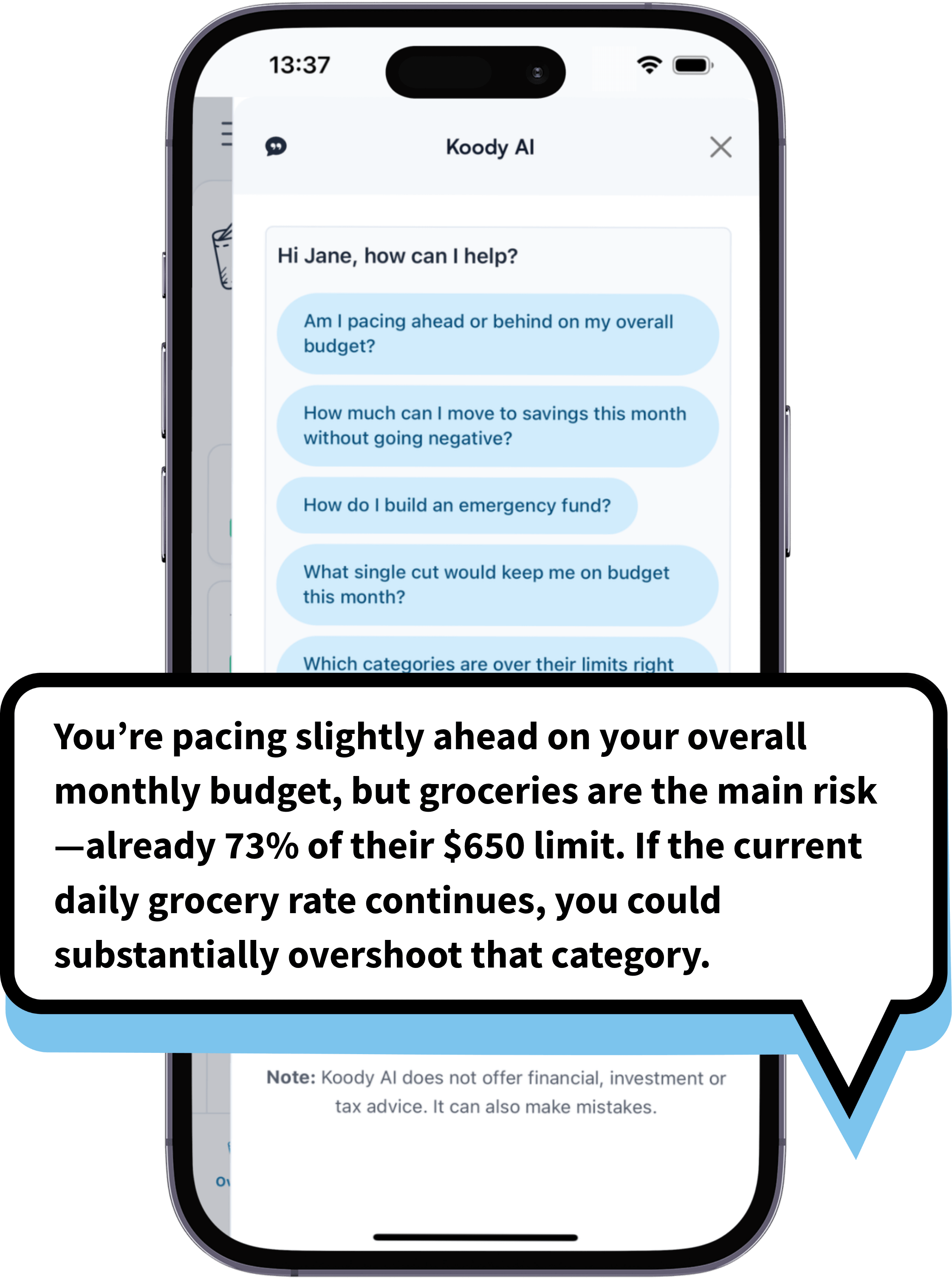

Koody AI

Clarity on demand.

Ask questions like "Can I afford this?", "What's my average daily spend?", or "Which categories are trending up?" Koody AI helps you make decisions with confidence, using the data you've chosen to track.

- Ask plain-English questions about cash flow, budgets, and trade-offs.

- Run quick what-ifs before you commit to a purchase or plan.

- Get practical nudges: pacing checks, category tweaks, and budget adjustments you can use right away.

Pricing

Start with a free month of our Standard plan to see if it fits. Cancel anytime — no questions asked.

First month free. No credit card required.Input transactions manually

Add bank accounts

Track spending and income (up to 1 year)

Categorize transactions

Monitor subscriptions or bills

Upload receipts

Estimate your tax bill

Access on mobile and desktop

Everything in Free

Track spending and income (up to 3 years)

Add new categories

Auto-generate recurring transactions

Create and manage budgets

Sync budgets with your payday

Invite family or friends to collaborate

Set budget permissions

Everything in Standard

Import transactions from bank statements

Track spending and income (unlimited years)

Automatic transaction categorization

Unlimited categories

Automatic detection of recurring transactions

Advanced Koody AI

Keep budgets active indefinitely

Frequently Asked Questions

Quick answers for people who want to budget without connecting bank accounts.

No. Koody works fully without bank linking. You can add accounts manually and start tracking right away.

Yes. You can upload transactions via CSV bank statements when you want to pull history in quickly.

You can start manual-first and still keep the door open for connections later. Your setup won't be wasted either way.

It can be surprisingly light. Many people enter transactions as they happen, and use recurring items + occasional CSV imports to reduce effort.