There is a specific kind of frustration that shows up after you have tried a few money apps.

You link your bank. It works until it does not. A connection breaks. Balances look off. Transactions arrive late, duplicated, or missing. Then you end up doing the one thing your bank always supports: downloading a CSV.

And you think, "Why can't I just upload this to my money app?"

This thread on r/budget and this on r/fintech asked exactly that. If your bank can export a CSV, why can a personal finance app not simply accept it? It is one extra step, but you are working with the same data your bank is willing to export.

This post is for people searching for a money management app with CSV import, not as a fallback, but as a normal way to run your finances. If you want a personal finance management tool that supports importing CSV files from your bank for quick setup, Koody is built for exactly that.

Koody is built for people who want CSV import as a normal workflow: upload, review, bulk-edit, and move on with your life.

- Import bank and credit card transactions from CSV exports.

- Bring history over from another app that supports CSV export (even simple trackers).

- Combine multiple institutions into one budget with consistent categories.

- Keep control over timing, privacy, and data quality.

Here is a step-by-step walkthrough of importing transactions into Koody:

CSV Import Makes Bank Sync Optional

CSV is not fancy, but it is dependable. Almost every bank and card provider can export transactions as a CSV. When you import that file, you bring in dates, amounts, descriptions, and whatever other fields your institution includes.

Many apps support file-based import as one option alongside bank linking. That is useful, but it often treats CSV as something you do only when syncing is not available.

A growing number of people choose CSV on purpose because they want:

- Fewer connection headaches.

- Control over when data enters the app.

- Coverage for banks and accounts that are not supported by sync providers.

- A simple way to import historical transactions.

If that is what you are looking for, the real question becomes: what should a CSV-import money app do well?

What to Look for in a CSV-Import App

Lots of apps can technically import a CSV. Far fewer make it feel smooth. Here are the things that matter most.

1. Import Should Not Start With A Setup Checklist

Some tools require manual field mapping. You have to tell the app which column is Date, which column is Amount, and which column is Merchant. That is fine for power users, but it adds friction for everyone else.

A strong CSV workflow assumes: if you downloaded the file, you have already done your part.

2. Auto-Categorization Should Help Without Taking Over Your Structure

If everything imports as Uncategorized, you are doing the work the app should do. But the other extreme is not great either: importing categories in a way that leaves you with a long list you never wanted.

The sweet spot is sensible categorization that gets you to a useful breakdown quickly, plus an easy way to adjust anything you do not like.

3. Recurring Detection Should Use Your History

One of the biggest benefits of importing is history. History makes patterns obvious. A good CSV-import app should help you spot subscriptions, rent, utilities, insurance, regular transfers, and recurring charges that quietly add up.

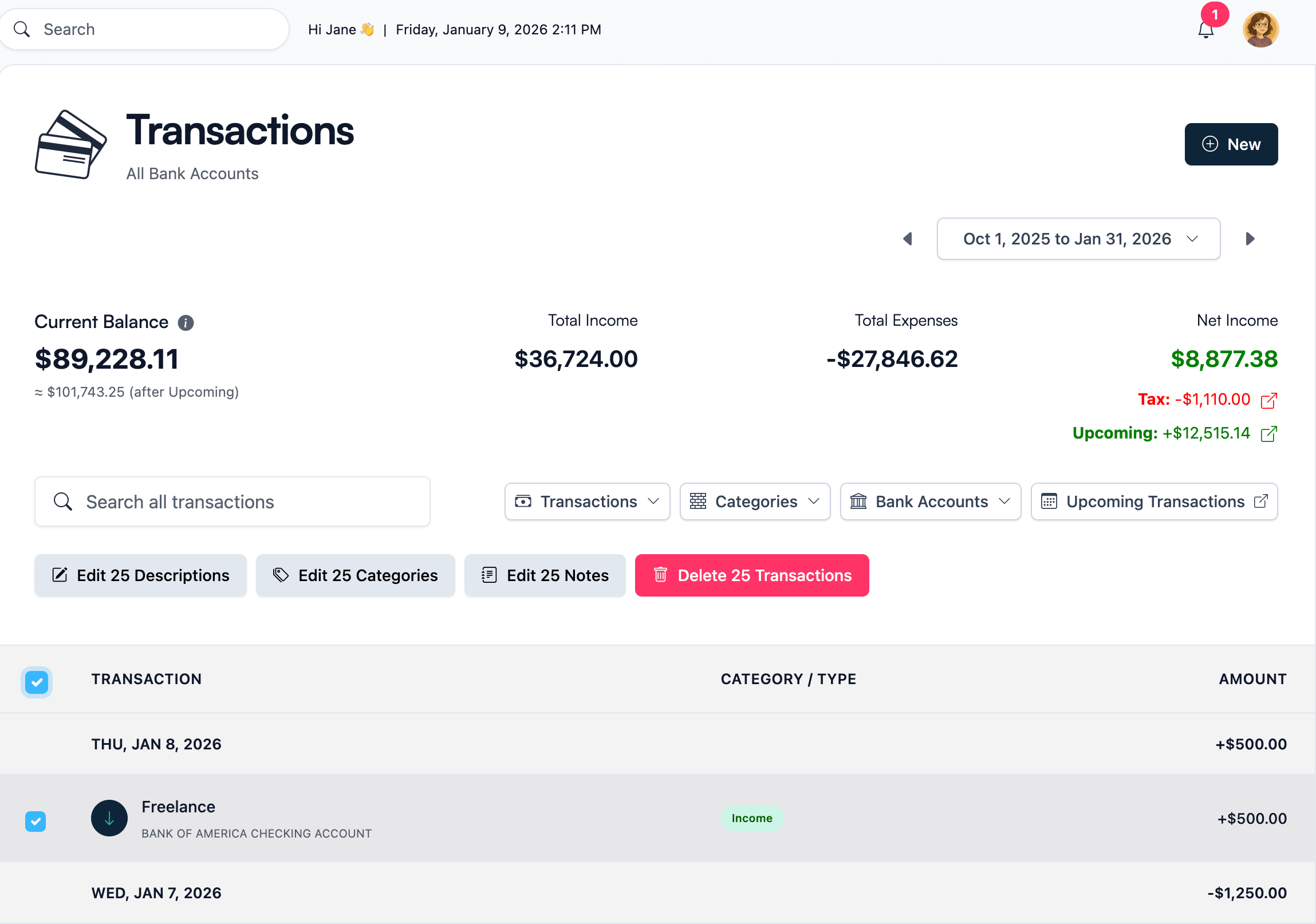

4. Bulk Edit Should Make Fixes Fast

Every import needs some cleanup. The question is whether it takes minutes or hours. Bulk edit is what makes the workflow practical:

- Re-categorize a group of similar transactions at once.

- Rename a merchant across months of history.

- Fix a batch of transfers or refunds in one go.

- Mark recurring payments quickly.

5. Repeat Imports Need Duplicate Protection

If you import weekly or monthly, overlap happens. A good importer helps you avoid double-counting the same transactions across multiple uploads.

6. Privacy And Control Matter

CSV import is often chosen by people who want more control. You download the data yourself, upload it yourself, and decide when updates happen. If you care about that, CSV import is a clean approach.

What a Good Import Experience Feels Like

Bank exports are inconsistent. Some include duplicate header rows. Some have totals lines. Some use odd delimiters. Some mix extra codes into descriptions.

A good importer quietly cleans that up so the review screen is about your money, not formatting.

The best CSV import experience is not one where issues never happen. It is one where:

- Most problems are handled automatically.

- The review screen makes the remaining issues obvious.

- Bulk edit makes fixes quick.

That is what turns CSV import into something you can do regularly without dreading it.

How Koody Handles CSV Imports

Koody treats CSV import as a primary workflow, not a last resort.

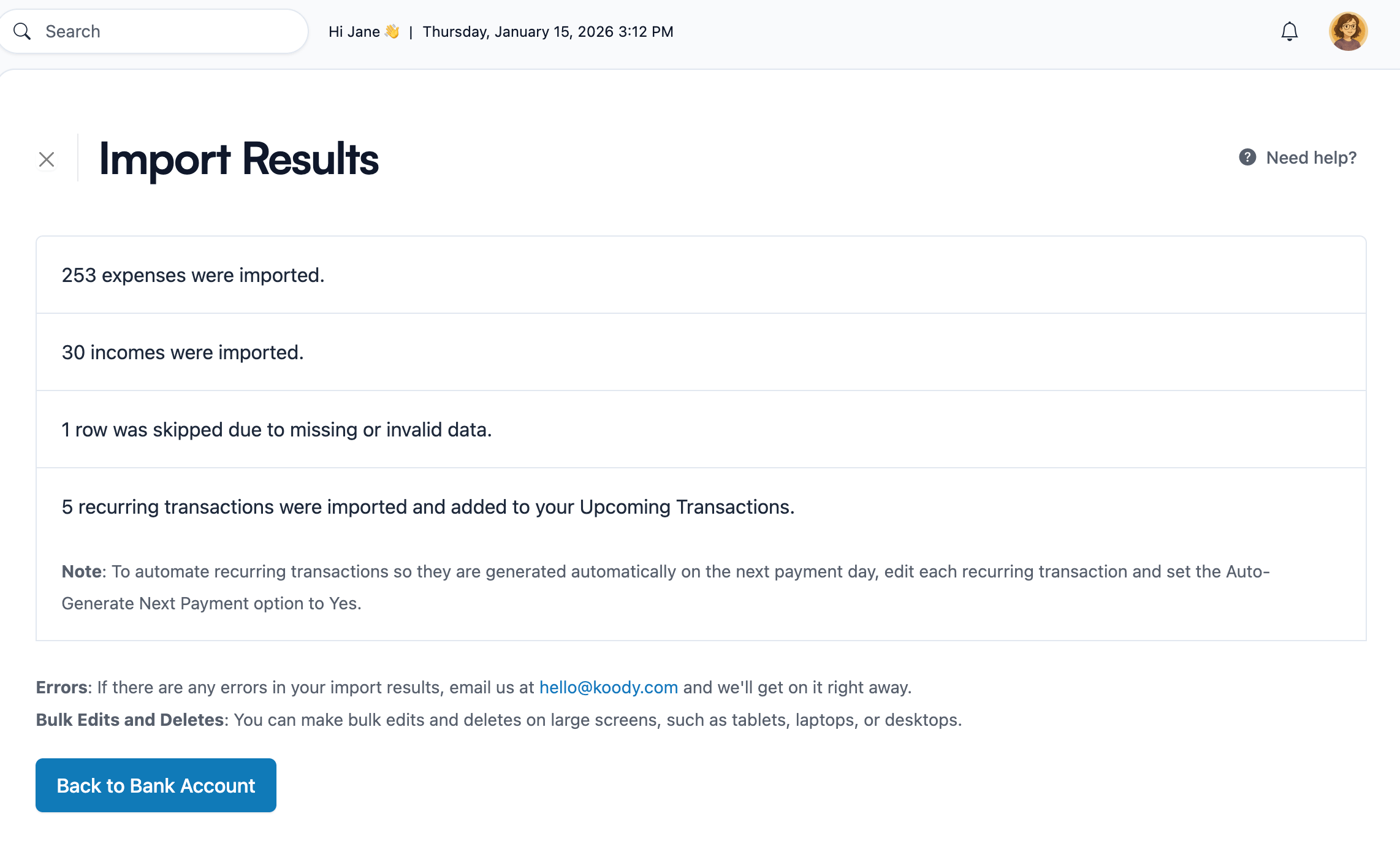

The idea is simple: upload your CSV, Koody handles the cleanup and organization automatically, then you review the results and bulk-edit anything you want to change.

In practice, it looks like this:

- Upload a CSV from your bank, credit card, spreadsheet, or another app export.

- Koody cleans the file automatically.

- Koody auto-categorizes transactions so you start with a useful breakdown.

- Koody flags likely recurring transactions based on patterns.

- You review and bulk edit anything you do not like.

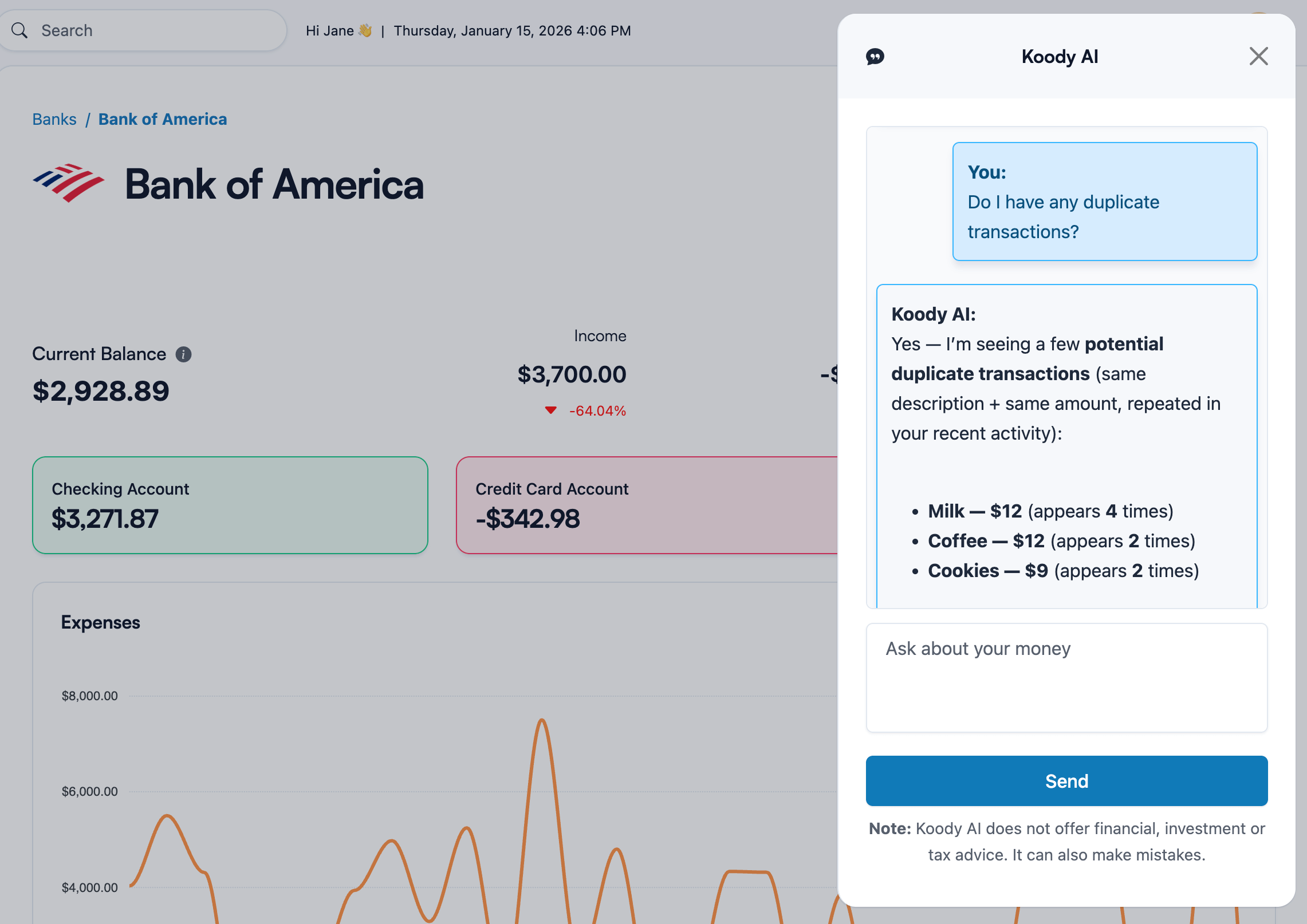

- Koody AI can guide you if you get stuck while reviewing.

Koody AI also learns from your bulk edits. When you change a category or clean up a merchant name, Koody AI applies that preference the next time it sees similar transactions, so imports get faster over time. It might take a few weeks for Koody AI to learn from your changes, but it will learn.

If you want to learn more about the AI copilot itself, see Koody AI.

What You Can Import

Most people start with one account, then expand:

- Import your primary checking account CSV.

- Add your main credit card CSV, where most spending often lives.

- Import anything else that matters, such as another card, savings, or a spreadsheet you maintain.

When CSV import is treated as a first-class feature, you can build a complete picture of your finances without depending on bank sync coverage.

Common CSV Import Problems

When people struggle with CSV import, it is usually one of these:

- Refunds and credits interpreted inconsistently.

- Descriptions missing or stored in an unexpected column.

- Duplicate rows from overlapping date ranges.

- Dates formatted differently across institutions.

A good importer does not pretend these never happen. It makes them easy to handle with automatic cleanup, a clear review screen, and bulk edit tools.

Next Steps If You Want The Exact How-To

This post is meant for people comparing apps and searching for a personal finance app with CSV import.

If you want the click-by-click walkthrough inside Koody, including what to upload and what the review flow looks like, start here: How To Import Your Transactions Into Koody.

FAQs: CSV Import For Money Management

1. Can I Import Transactions Without Linking My Bank?

Yes. Koody's CSV import is designed for that. Download a CSV from your bank or credit card, upload it into Koody, and choose how often you want to update.

2. Can You Recommend A Personal Finance Management Tool That Supports Importing CSV Files From My Bank For Quick Setup?

Yes. Koody is built for quick setup with bank statement CSV imports. Upload your file, and Koody handles common cleanup, auto-categorizes to get you to useful spending breakdowns quickly, flags likely recurring items, and lets you bulk-edit anything you want to change.

3. Can I Import Data From Multiple Financial Institutions Seamlessly (Multiple Banks And Credit Cards)?

Yes. You can import separate CSV files from multiple banks and cards into the same Koody budget. Most people start with checking, then add their main credit card, then bring in any other accounts that matter so everything ends up in one place with consistent categories and filters.

4. Which Money Management Tool Supports Importing My Financial Dashboard Data From Another App?

If your current app lets you export transactions as a CSV, you can import that history into Koody. Most "dashboard" tools store their charts and insights differently, but the underlying transactions and categories are usually exportable. Once your history is in Koody, you can rebuild budgets and reporting based on the same data.

5. Which Personal Finance Management Software Supports Importing My Spending Insights From A CSV File?

In most cases, "spending insights" come from transactions. Importing your transaction CSV is the direct way to bring those insights over, because once the history is in Koody, you can filter, categorize, and review spending patterns from the same underlying data.

6. Is There A Money Management App That Can Import My Monthly Budget Template From A CSV File?

Koody's CSV import is focused on transactions (the hardest part to move). If you have a budget template spreadsheet, the fastest approach is usually to recreate your category list and monthly limits once inside Koody, then let your imported spending flow into those categories.

7. What File Type Should I Use: CSV Or Excel?

Use CSV whenever possible. If your bank gives you an Excel file, you can save or export it as CSV first. Note that some banks, like Bank of America, will give you a CSV file, but call it an Excel file. If the file extension is .csv, for example, stmt.csv, Koody can usually work with it.

8. Will Koody Automatically Categorize Imported Transactions?

Yes. Koody auto-categorizes after import, then you can bulk edit anything you want to change. If you are looking for AI transaction categorization, this is the practical version: Koody makes a smart first pass, then you can re-categorize up to 500 transactions at once using bulk edit.

9. Does Koody Learn From My Changes Over Time?

Yes. When you clean up merchant names or adjust categories using bulk edit, Koody carries those preferences forward so future imports require less cleanup.

10. What If My CSV Already Has A Category Column?

If your CSV includes a Category column, Koody can use those categories as a starting point. If you prefer Koody to auto-categorize from scratch, remove or rename the Category column before uploading.

11. If I Import Again Next Month, Will I Get Duplicates?

Koody checks for duplicates against transactions you previously imported and will refuse to import duplicates. That means you can safely import on a schedule without worrying that the same bank CSV will double-count your history. Note: this duplicate protection applies to imports compared to previous imports. If you manually entered a transaction that also exists in your CSV, that can still create a duplicate, and it is worth reviewing after your upload. If you are unsure, you can ask Koody AI to help you spot likely duplicates so you can clean them up quickly.

12. Do I Need Perfect Data Before I Start?

No. Start with one account and a recent date range, then improve as you go. A workable system today beats waiting for a perfect spreadsheet.

13. Can I Import Investment Tracking, Retirement, Or Calculator CSVs?

If the file is transaction-like (date, description, amount), you can usually import it into Koody. If it's a holdings or performance export (positions, tickers, allocations), that's typically a different format than a transaction ledger, so most people keep that in an investment tool and import only the cash-flow side they want reflected in their budget.

Ready to bring your data into one place? Create an account and upload your first CSV today.