Koody helps you make SMART financial decisions.

Most people aren't taught how to budget or manage money. We built Koody to change that. Koody empowers you to spend, save, and plan with confidence, even if you're starting from scratch — no bank connection required.

How it works

Managing your money shouldn't require perfect habits or perfect systems.

Whether you're just starting to take control of your finances or looking for a better way to stay organized, Koody is designed to meet you where you are. You can enter things manually or import past transactions; whatever works best for you. However you use it, you'll always get clarity, simplicity, and support.

Add Your Accounts

Create your bank and corresponding bank accounts with our simple interface. It is easy, does not require a connection to your actual bank account, and takes less than 30 seconds to complete. Our intuitive design makes it a breeze to organize your accounts so you can skip the confusion and focus on what matters.

Track What Matters

Add your transactions manually as they happen or upload your bank statements in one quick go. Manually added transactions let you choose categories on the spot, while imported ones are automatically sorted for you, helping you understand where your money's going and where it shouldn't be.

Stay On Plan, Effortlessly

Once your accounts and transactions are in, everything starts to come together. Set budgets, create goals, track your progress, and let the app do the heavy lifting. Whether it's building savings, avoiding overdrafts, or making sure you don't overspend before payday, we've got your back.

Koody is an ideal spending tracker and budgeting app for most people, including singles, couples, families, households, and students. And you absolutely do not need to link your bank accounts to use it.

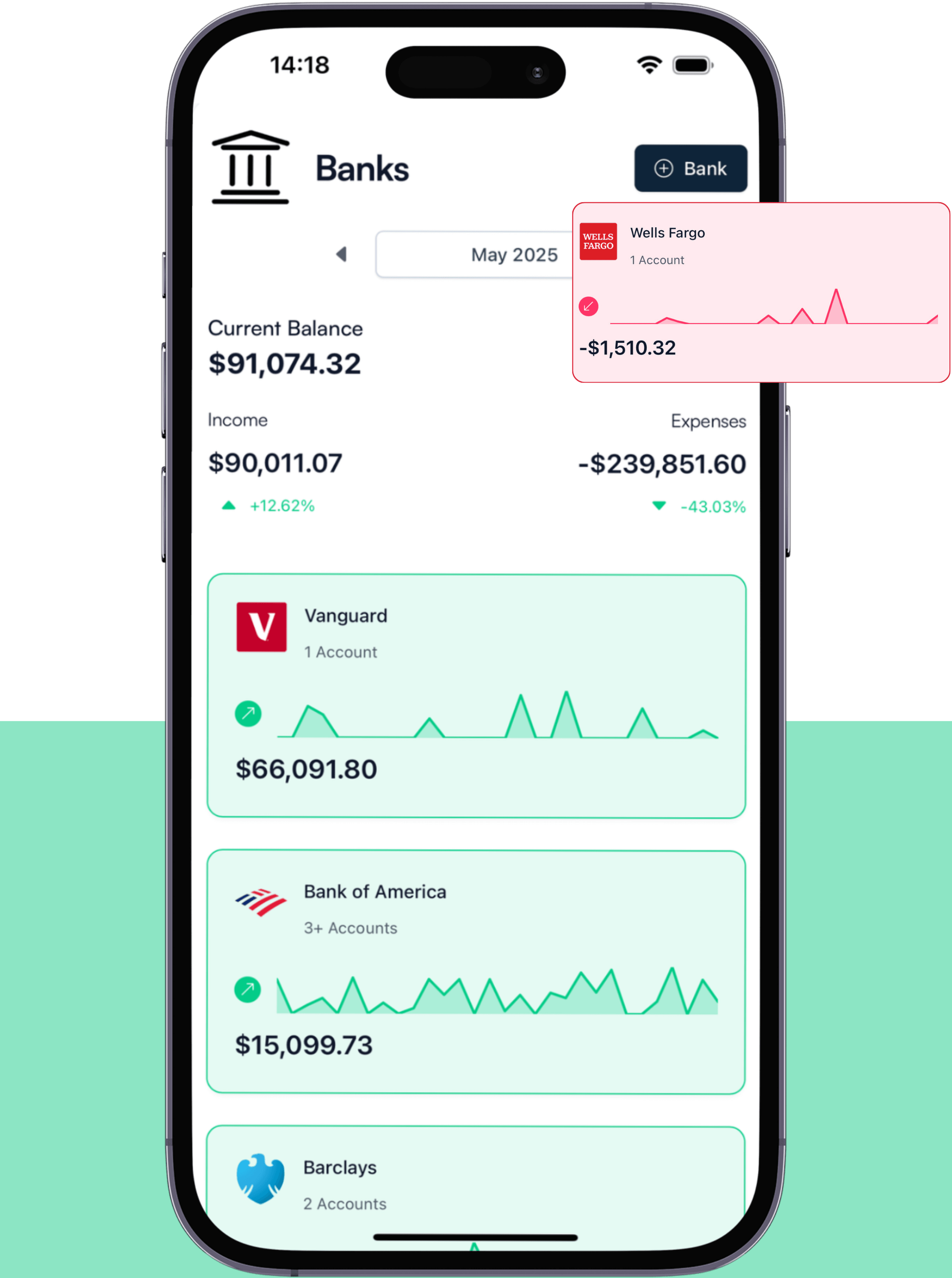

BANK ACCOUNTS

Add your bank accounts to see them all in one place.

Whether it's a checking account, a retirement account, a crypto wallet, or even the cash you keep on hand, it all counts. Koody gives you a complete picture of your finances by letting you add any type of account, manually.

It's quick to set up and designed to work around your life, not the other way around.

- See all your accounts, including checking, savings, investments, and more, in one unified dashboard.

- Add accounts manually with our clean, simple interface.

- Keep track of your full financial picture, including crypto, retirement, and cash on hand.

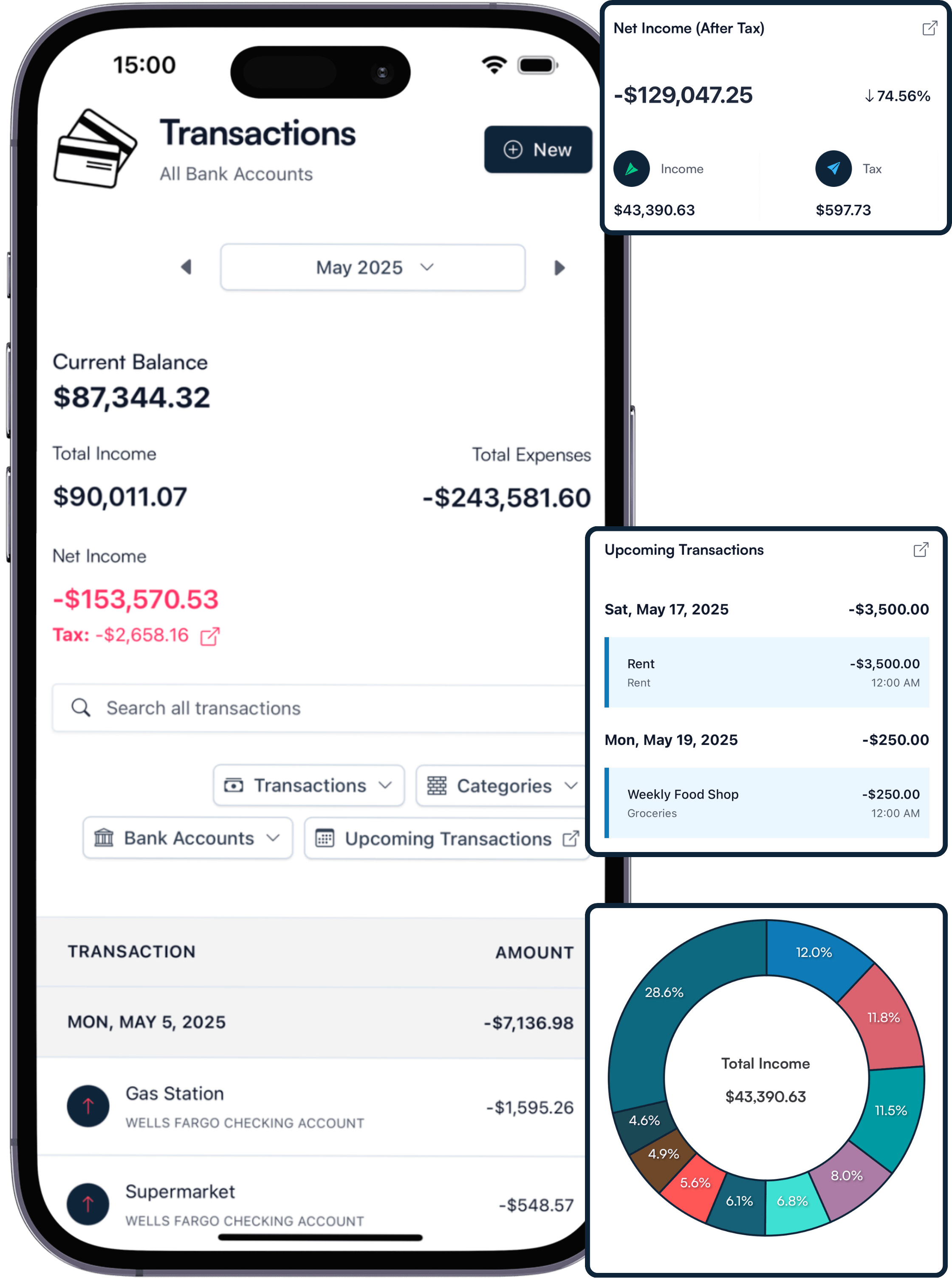

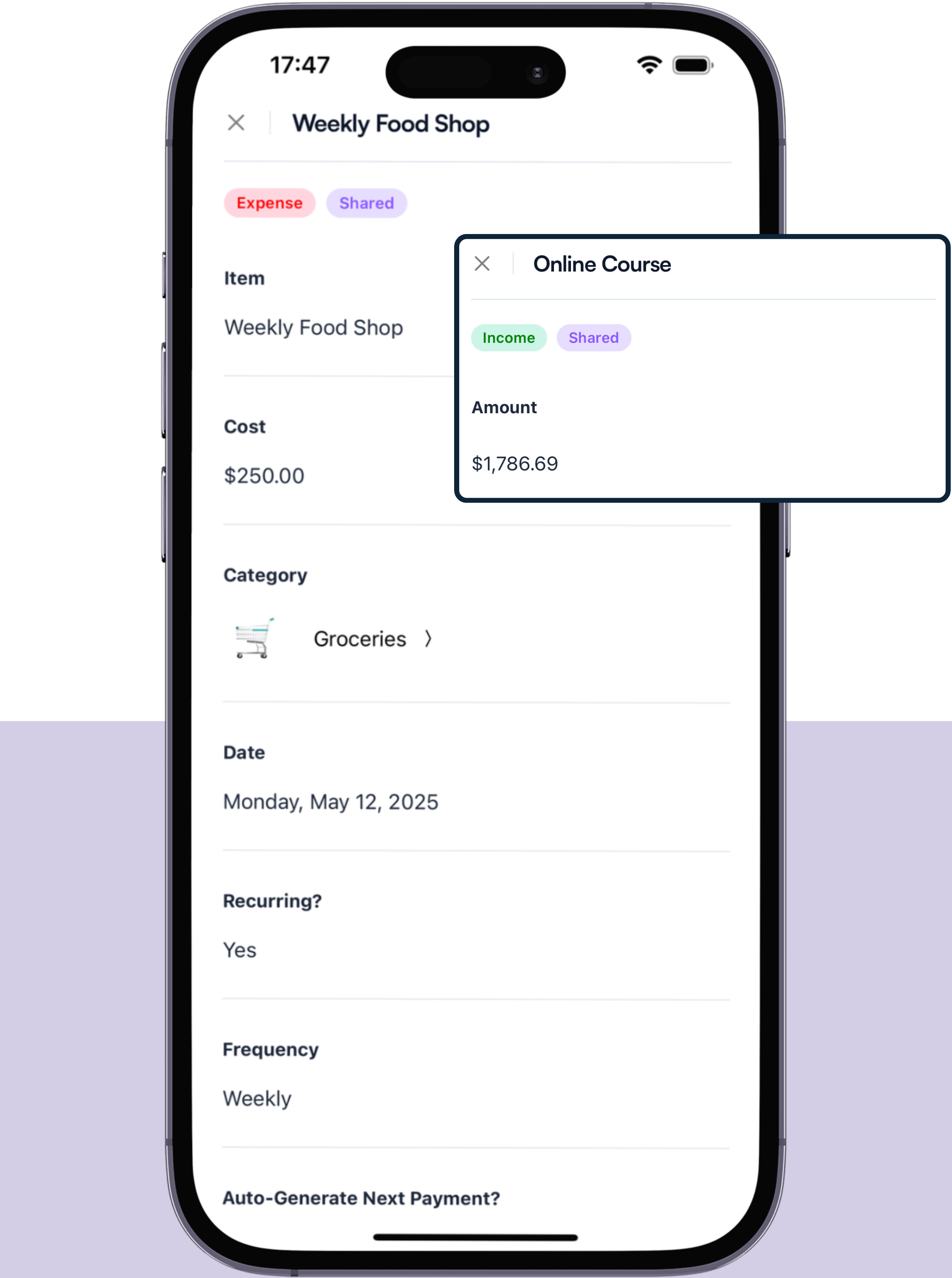

INFLOWS AND OUTFLOWS

Track what's coming in, what's going out, and what's due next.

Whether you log transactions manually or let the app pull them in from your bank statements, everything is built to be flexible and easy to maintain. You can track one-off payments, set up recurring bills or paychecks that generate themselves on the right day, and even tag income that has tax due, so nothing sneaks up on you.

From everyday spending to long-term planning, this is how you stay on top of your money without losing track of the details.

- Log income and expenses manually or import them directly from your bank statements.

- Set up recurring payments to track subscriptions, salaries, or bills with zero effort.

- Mark income as taxable so you know exactly what's yours and what you owe.

BUDGETS

Build a budget that fits your life (not the other way around).

Koody is designed to be flexible, forgiving, and actually useful. You can create monthly or custom budgets, track your spending by category, and adjust things as life changes, because it always does.

Recurring expenses are automatically factored in, and you can carry over leftover amounts, making sure every dollar has a job without it feeling like a chore. Whether you want to save more, spend better, or just stop running out of money before the end of the month, your budget becomes your guide, not your judge.

- Create dynamic recurring or one-off budgets that adapt to your income, lifestyle, and goals.

- Track spending by category and adjust in real-time as life happens.

- Get a clear view of how much is left, what's overspent, and what's ahead.

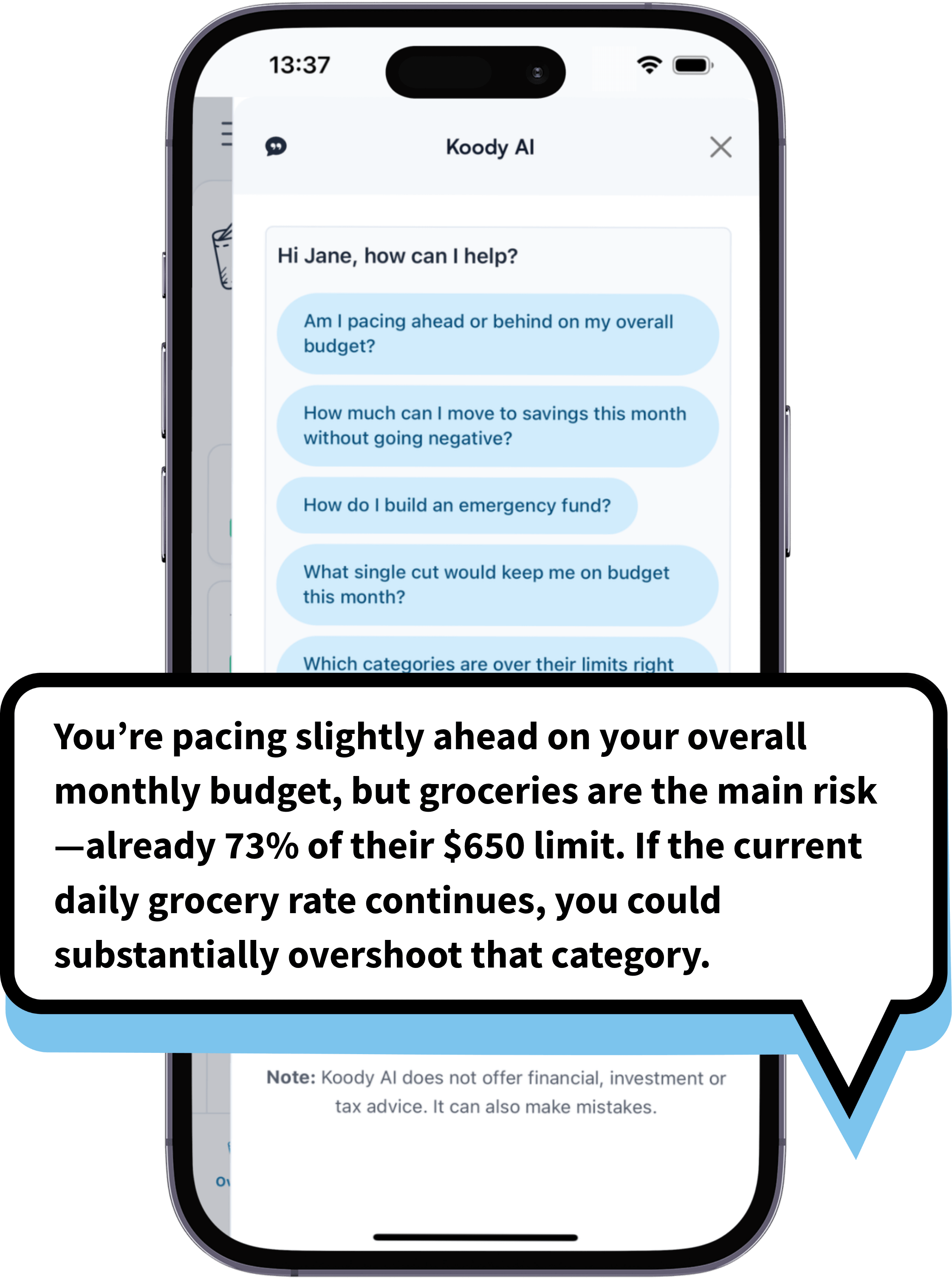

Koody AI

Chat with your money.

Have a real conversation with your money. Ask plain-English questions like "Can I afford this trip?", "Which accounts are at risk of being overdrawn?", or "What's my average daily spend this week?" Koody AI looks at your budgets, recurring items, and transactions to give you clear, grounded answers and actionable next steps.

It's there when plans change, when you need a quick what-if, or when you want a nudge to stay on track. Think of it as a practical copilot that helps you make decisions with confidence.

- Ask natural questions about cash flow, balances, goals, and trade-offs.

- Run simple what-ifs to see the impact on this month's budget and the months ahead before you commit.

- Turn insight into action with suggested category tweaks, savings targets, and pacing checks you can use right away.

COLLABORATION

Money is easier to manage when you're not managing it alone.

Whether you're sharing finances with a partner, supporting a family, or managing a household with roommates, transparency matters. Our collaboration tools let you invite the people you trust to share access to your budgets and bank accounts, so everyone stays on the same page without the awkward spreadsheets or endless back-and-forths.

You decide what they can see and do. Collaborators can help track spending, add transactions, adjust budgets, and keep everything updated in real time. No more “did you pay that bill?” texts or “where did all the money go?” arguments. Just shared clarity, mutual ownership, and a lot less stress.

- Invite your partner, family, or housemates to collaborate on budgets and accounts.

- Set permissions to control who can view, edit, or manage each part of your finances.

- Build accountability and shared goals without losing track or control.

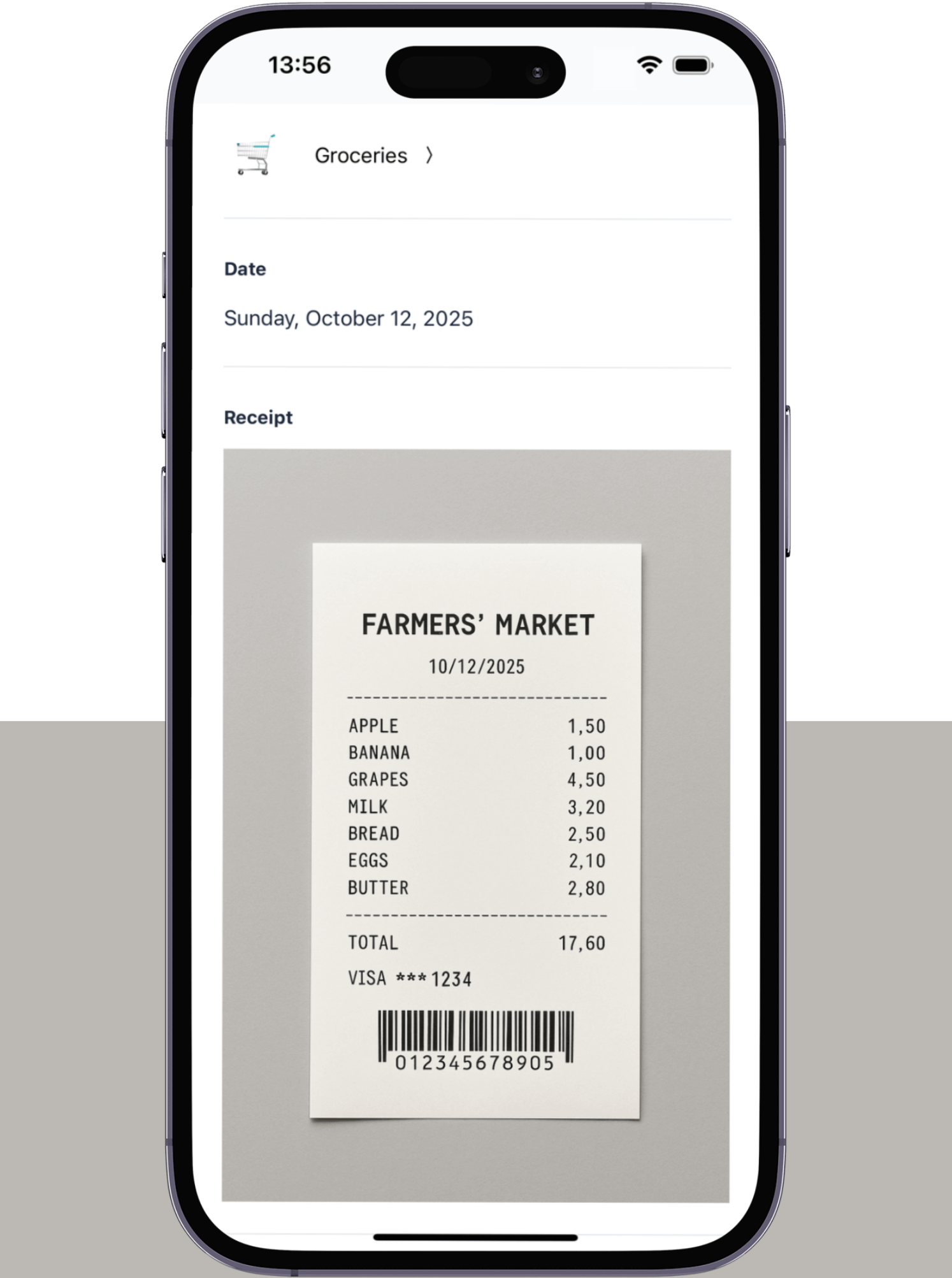

EXPENSE RECEIPTS

Snap a photo of your receipts and store them digitally.

With Koody's Receipts feature, you won't have to continually fish for receipts at the bottom of your bag, risk misplacing them, or worry about the all too familiar problem of your receipt ink fading.

Simply snap a photo of your receipts and store them digitally so you can access them at any time, all in one place.

Whether it's a grocery run, new tires, or a business expense, your paper trail stays with your finances, not buried in your camera roll.

- Capture and store receipts in seconds, right inside Koody.

- Keep receipts alongside the matching expenses so context is never lost.

- Access your receipt library on mobile and web, whenever and wherever you need it.

Pricing

Our pricing is flexible and straightforward: no hidden fees, no surprises. Start with a free month of our Standard plan to see if it's right for you. If it's not, cancel anytime. No questions asked.

First month free. No credit card required.Input transactions manually

Add bank accounts

Track spending and income (up to 1 year)

Categorize transactions

Monitor subscriptions or bills

Upload receipts

Estimate your tax bill

Access on mobile and desktop

Everything in Free

Track spending and income (up to 3 years)

Add new categories

Auto-generate recurring transactions

Create and manage budgets

Sync budgets with your payday

Invite family or friends to collaborate

Set budget permissions

Everything in Standard

Import transactions from bank statements

Track spending and income (unlimited years)

Automatic transaction categorization

Unlimited categories

Automatic detection of recurring transactions

Advanced Koody AI

Keep budgets active indefinitely

Helpful Articles From The Koody Blog

Frequently Asked Questions

1. Can I budget without linking my bank account?

Yes. Koody is designed for people who prefer not to link their bank accounts. Whether you're in the US, UK, Canada, Australia, or elsewhere, Koody is a free budgeting app that lets you set budgets, track spending, categorize expenses, set savings goals, and upload receipts—all without connecting to your bank. It's a great choice if you want the benefits of a modern budgeting app without linking your bank accounts.

2. Why can't I add income, expenses, or budgets yet?

Create at least one bank and one bank account first (without connecting to your actual bank). After the first account exists, the Add Income, Add Expense, and Add Budget actions will unlock.

3. How do I add an account?

To add an account, go to Banks, choose the bank you want, then select New > Account. From there, enter your account details (like the name and current balance) and save.

4. Can I change the budget start and end dates to match my pay period?

Absolutely. Koody allows you to customize your budget cycle to align with your pay schedule, whether it's weekly, bi-weekly, or monthly, providing a more accurate financial overview. You can even apply this custom date range globally, so the entire app uses your budget dates. To set a global date range, click the Custom Date Range button anywhere you see a date drop-down button in the app.

5. Can I add a new category?

Yes, you can create as many custom categories as you need. This feature helps you tailor your budgeting to reflect your unique spending habits and financial goals.

6. How do I add my income?

You can add income manually or import it from your bank statements. This flexibility ensures you can track your earnings accurately, regardless of your preferred method.

7. How do I change my current balance?

To change your current balance, go to Overview > New > Current Balance, select the bank account, enter the amount and date, and save. This updates the account's current balance used for calculations, charts, and transfers.

8. Can I transfer money between my accounts?

Yes, go to Overview > New > Transfer to move money between accounts.

9. Where do I import transactions in Koody?

To import transactions into Koody, go to Overview > New > Import Bank Transactions.

10. Can I make bulk edits and deletes?

Yes. On tablets, laptops, and desktops, navigate to the Transactions tab to use checkboxes and bulk actions. On phones, edit or delete items one at a time.

11. Can I add my own category column to my CSV file before importing my transactions?

Yes. If you'd like, you can add a Category column to your CSV and fill in your categories before you import. But you don't have to — your imported transactions are automatically categorized, and if anything looks off, you can quickly fix it with bulk edits, which is usually easier than editing the CSV itself.

12. Will Koody remember the description and category changes I make after importing?

Yes. When you edit an imported transaction and accept the apply-to-similar prompt, Koody updates matching transactions from the same import and remembers that change for future imports. If you decline, only the one you edited changes.

13. How do I use column mapping during a CSV import?

Column mapping appears only when Koody cannot confidently read your CSV headers or structure. On the Column Mapping screen, select the Date, Description, and Amount columns, optionally choose a Category column, and set the sign convention if needed. Then click Import Using These Columns, and the import will run as usual. If you do not see this column mapping step, your file was mapped automatically.

14. Why did my CSV import fail or show "No description"?

This usually comes down to bank-specific CSV formats. Email us at hello@koody.com, and we'll sort it out immediately.

15. I imported my CSV successfully in Koody, but I can't find the transactions. Where did they go?

Most of the time, this happens because you're viewing the wrong date range. Go to the Transactions tab and find the date range button (top right on desktop, middle on mobile). Select a range that matches the dates in your CSV, then your imported transactions should appear.

16. Can I track recurring transactions?

Yes, Koody allows you to set up recurring transactions for both income and expenses. These transactions are automatically generated on the specified dates, helping you stay on top of regular financial commitments.

17. Does Koody support tax tracking for income?

Indeed, you can mark income as taxable, and Koody will help you track the amount owed. This feature is particularly useful for freelancers and self-employed individuals managing their tax obligations.

18. Can I use Koody in my country?

Yes, Koody is available globally, including in the US, UK, Canada, Australia, and many other countries. We support various currencies and banking systems, making it accessible for users worldwide.

19. Can I change my currency?

Yes, Koody supports all global currencies. You can set your preferred currency in the Settings menu, making it convenient to manage your finances in your local currency wherever you are in the world. Simply head to Settings and pick your preferred currency from our comprehensive list.

20. Can my partner and I share Koody?

Yes, you can. Koody supports collaboration, allowing you to invite your partner, family members, or roommates to share and manage budgets and bank transactions together. You can control permissions, ensuring everyone stays informed and aligned without compromising privacy.

21. Is my financial data secure?

Security is our top priority. We use bank-grade encryption and adhere to strict privacy protocols to protect your data. Your information is never shared without your consent, ensuring your financial data remains confidential.

22. What happens if I cancel my subscription?

If you cancel during your free trial, you won't be charged, and your access to our premium features will end when the trial expires. If you're already on a paid plan, you'll keep access until the end of your current billing cycle. After that, your account will no longer have access to our premium features. You can always come back and reactivate a paid plan later. We'll securely store the data associated with the premium features for a limited time in case you decide to return.

23. How do I delete my account?

To delete your account, navigate to 'Edit Profile' and select 'Delete Account.' Please note that this action is irreversible and will permanently remove all your data.

24. Where is Koody located?

Koody is headquartered in San Francisco, California, USA. We also have an office in London, UK.